Long Calendar Call Spread - The Options Playbook

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. You’re taking …

Calendar Spreads in Futures and Options Trading Explained

Mar 11, 2025 · A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different …

Calendar Spread Options: What They Are and How They Work | SoFi

Mar 27, 2025 · A calendar spread, also known as a horizontal spread, is an options trading strategy that is created by simultaneously taking a long and short position on the same …

Long Calendar Spread with Calls - Fidelity

To profit from a directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction. A long calendar spread with calls is created by …

Calendar Spread Options Strategy: Beginner's Guide

Aug 4, 2025 · In this article, we'll cover everything you need to know about the calendar spread—when to use it, how to set it up, how to manage it, and some go-to tips for making it …

Exploring Calendar Spreads in Options Trading | TradeStation

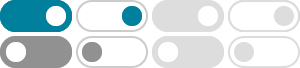

There are two types of calendar spreads: long and short. Additionally, two variations of each type are possible using call or put options. A trader may use a long call calendar spread when they …

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Mar 15, 2024 · A call calendar spread consists of selling-to-open (STO) a short call option and buying-to-open (BTO) a long call option at the same strike price, but with a later expiration date.

Calendar Spread - Definition, Option Strategy, Types, Examples

A calendar spread (or time spread) refers to a market-neutral strategy of buying a long-term call option and selling a short-term call option of the same derivative simultaneously, having the …

The Calendar Call Spread - Neutral Market Trading Strategy

The calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn’t move, or only moves a little.

Calendar Spreads 101 - Everything You Need To Know - Options …

Apr 27, 2020 · Calendar spreads and butterfly spreads have quite similar payoff diagrams in that they have the tent shape, but there are slight differences. The main difference between the …